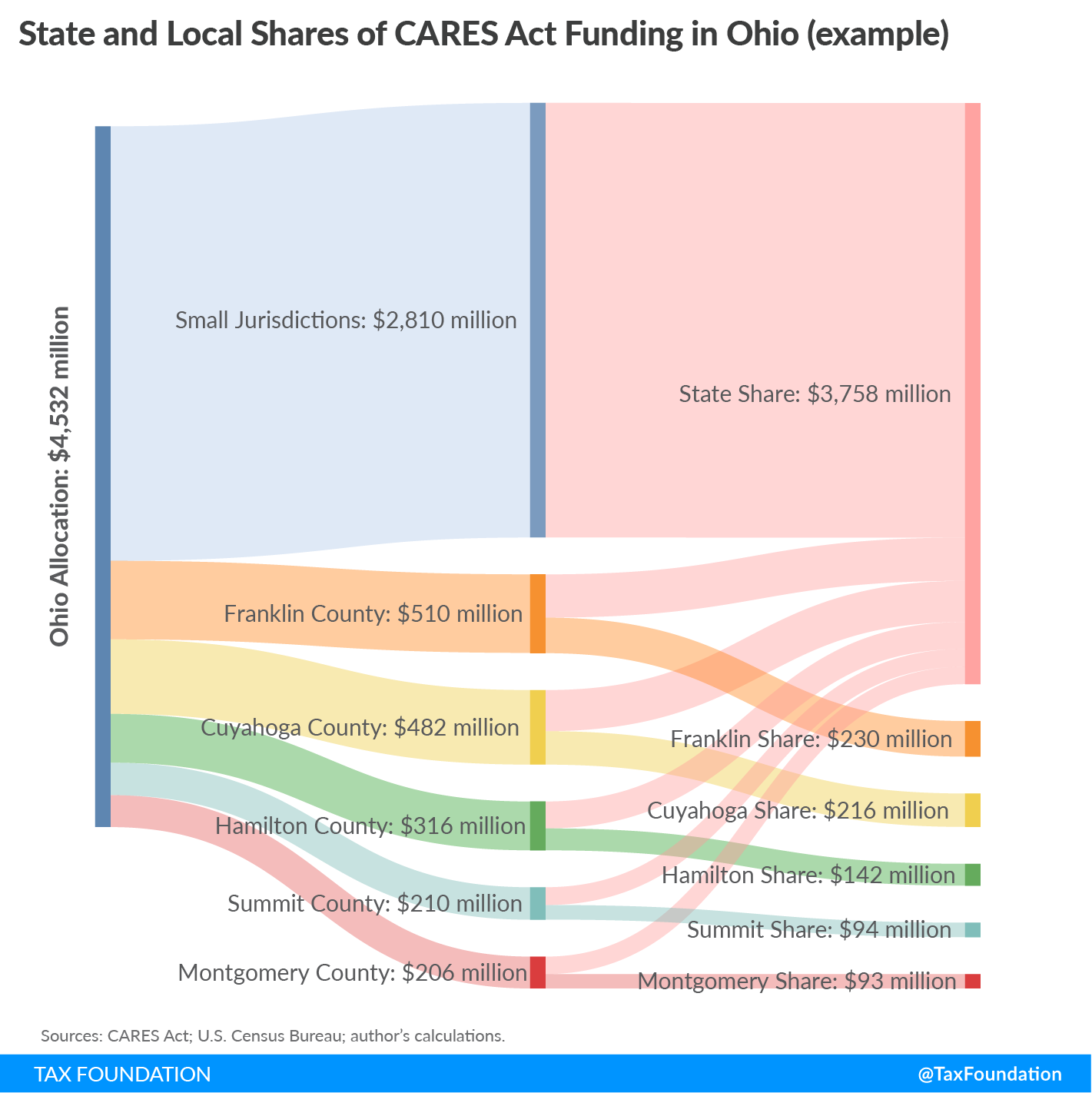

- $1.72 billion is associated with that share of the population

- These counties can claim 45 percent, or $775 million, of this total

- The state retains the remaining 55 percent associated with this population ($946 million)

- $2.81 billion is associated with this share of the population

- That entire amount goes to state government

The diagram below illustrates this concept. Note how state and eligible local governments split the funding associated with their populations, while the state retains all money associated with the share of the state’s population that lives outside an eligible jurisdiction.

funding totals in the CARES Act" width="1421" height="1422" />

funding totals in the CARES Act" width="1421" height="1422" />

Notably, the language of the CARES Act mentions counties, cities, and other local governing bodies—and, with a few exceptions, cities are situated within counties, meaning that in many cases there are overlapping eligible populations. The city of Columbus, Ohio, for instance, is the county seat of Franklin County, and both have populations in excess of 500,000.

It is not clear how the U.S. Treasury Department will handle such overlapping populations. One plausible interpretation is that the city can claim the share associated with its population and the county may claim the share associated with county residents outside the city. Treasury could also allow these jurisdictions to share the revenue in other ways. What is reasonably clear, however, is that they may not double up: Franklin County and all its subdivisions are entitled to a total of $230 million, however it may be divided between the city and county.

The following table shows how much is allocated to each state overall (state and local government combined), plus how that aid is broken out—the state share and the share for each eligible county or county equivalent (including independent cities). As with the example above, in some cases, cities within these counties may share in the amount indicated for the county.

This table uses the latest available population data, circa July 2019. It is possible that the Treasury Department will use different figures. The greatest possible effect of using a different population dataset would be the inclusion or exclusion of jurisdictions just on the cusp of the 500,000-person threshold. As of July 2019, for instance, Sonoma County, California had a population of 494,336, and Morris County, New Jersey had a population of 491,845. If either of these counties, or others that are in similar positions, were to exceed the 500,000 threshold under the count employed by the Treasury Department, local distributions would diverge slightly from the amounts indicated below.

Sources: CARES Act; U.S. Census Bureau; author’s calculations.

Errata: Due to a WordPress glitch with bullet points, this document was originally published omitting the first digit of Ohio’s population figures.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.