Top 5 Questions and Answers About Initial Deposits Into Escrow" width="800" height="450" />

Top 5 Questions and Answers About Initial Deposits Into Escrow" width="800" height="450" /> Top 5 Questions and Answers About Initial Deposits Into Escrow" width="800" height="450" />

Top 5 Questions and Answers About Initial Deposits Into Escrow" width="800" height="450" />

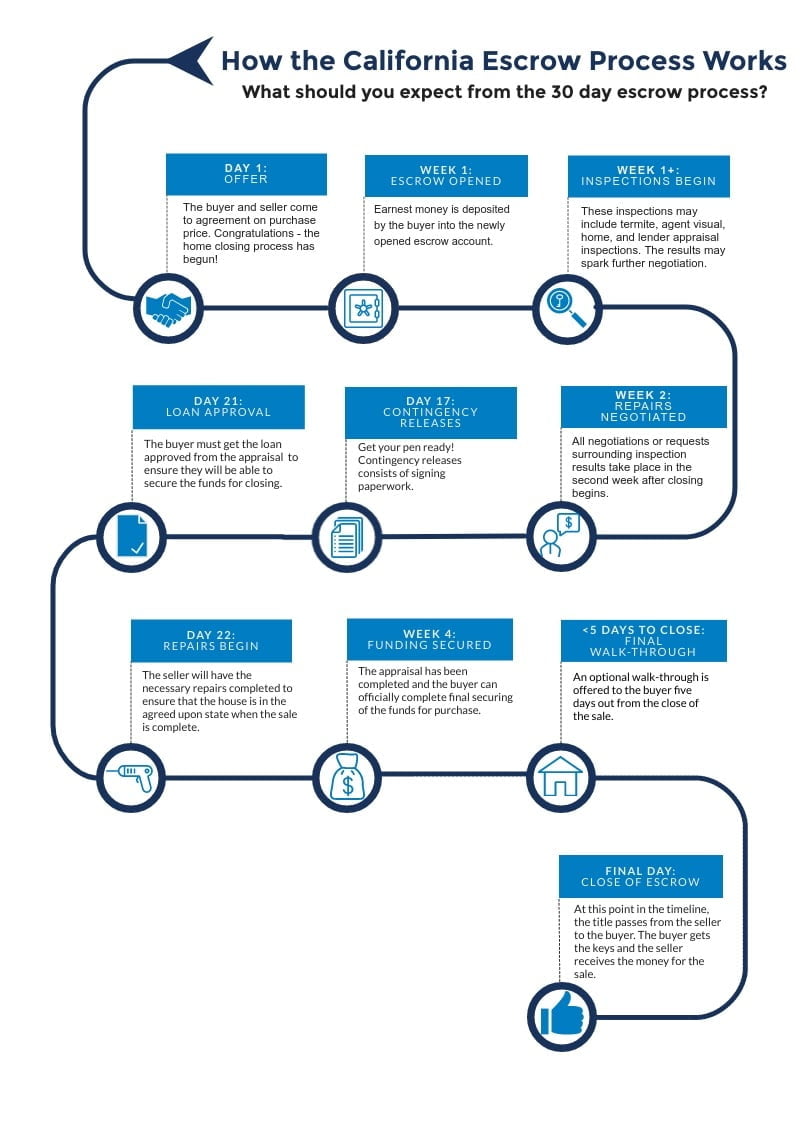

Escrow is a tricky concept to understand the first time around. It’s a multistep process that typically lasts between 30-60 days. However, it doesn’t have to be complicated! The key to understanding escrow is realizing that it doesn’t actually start until the home buyer and seller agree on an offer. After that, the buyer will need to make the initial deposit to show that they are committed to the purchase. Homebuyers, it is important that you have this payment factored into your budget! Sellers, you will want to be familiar with the terms related to this initial deposit into escrow. There are select situations when you might have to return the funds to the buyer. Let’s tackle your top questions about initial deposits into escrow!

No matter what you call it, plan on having this money available to start your escrow!

The standard escrow deposit is used to pay the closing costs and account fees. Generally, it’s split between the buyer and seller. This can vary, especially in 2021’s extremely competitive seller’s market .

As is often the case in real estate, the local market influences the escrow deposit amount. A good starting point is to expect the deposit to be 1% – 3% of the sale price .

Your real estate agent should be able to help you with a ballpark figure early on and provide guidance on the market norms. The specifics of the deposit amount should be reviewed and solidified when creating the initial contract.

Consider using an online calculator at the start of your house hunting to get the full picture of how much money you may need upfront to purchase a home. It also helps to know what funds are necessary each step of the way.

The initial deposit gets the ball rolling for the rest of the escrow steps.

After the initial deposit into escrow, you can begin inspections and negotiate repairs. At the same time, the financial processes and document preparation are underway.

The funds are safe in escrow at this time.

There are several checkpoints after the standard escrow deposit. Deadlines in the escrow process can be negotiated by both buyer and seller.

At these points, the homebuyer may have the chance to back out of the purchase agreement and receive their deposit.

The most commonly disputed dates in escrow include inspection contingency deadlines, title review deadlines, and loan contingency deadlines. Learn more about each type below!

This one is pretty straightforward. The home inspection contingency deadline is the date by which all home inspections must be complete!

If the buyer is unhappy with something about the property at this stage, then they can cancel the deal and get their money back. If this happens, the house in question would return to the market.

If the buyer realizes there is something they don’t like after the deadline, then the seller gets to choose what to do with the earnest money.

Part of escrow includes providing proof that the home legally belongs to the current owner.

In the event there is an issue with the title, the initial deposit will be returned to the buyer.

Finally, the loan deadline arrives. This is usually the last deadline in the process.

During escrow, the seller used the buyer’s initial escrow deposit as the indicator that the purchase will be feasible. Now, it is time to provide the actual proof that the buyer has procured the loan.

Sellers can legally decide to keep the money if the buyer is not able to show that they have the necessary funds for the home purchase.

If there are any disagreements over the escrow deposit, there is a chance legal action may be taken. State laws and the amount of money involved will determine what actions to expect.

The TRID laws got an overhaul in 2017. This update introduced a new series of defined timelines and guidelines related to fee disclosure in real estate transactions

The TRID laws have a nickname – the Know Before You Owe Act . The goal is to protect borrowers from predatory lenders.

Now, the lender and escrow agents have to rely on one another for the safe, accurate, and timely disclosure of all fees.

This makes it really important for you to introduce the lender and escrow company as soon as possible!

The more you know about escrow the better you will feel at the time of your initial deposit into an escrow account! Review some additional tips for getting through escrow .

Now that your questions about initial deposits into escrow are answered, consider a paperless escrow experience with the VentureTrac app . To get started, contact us at New Venture Escrow !